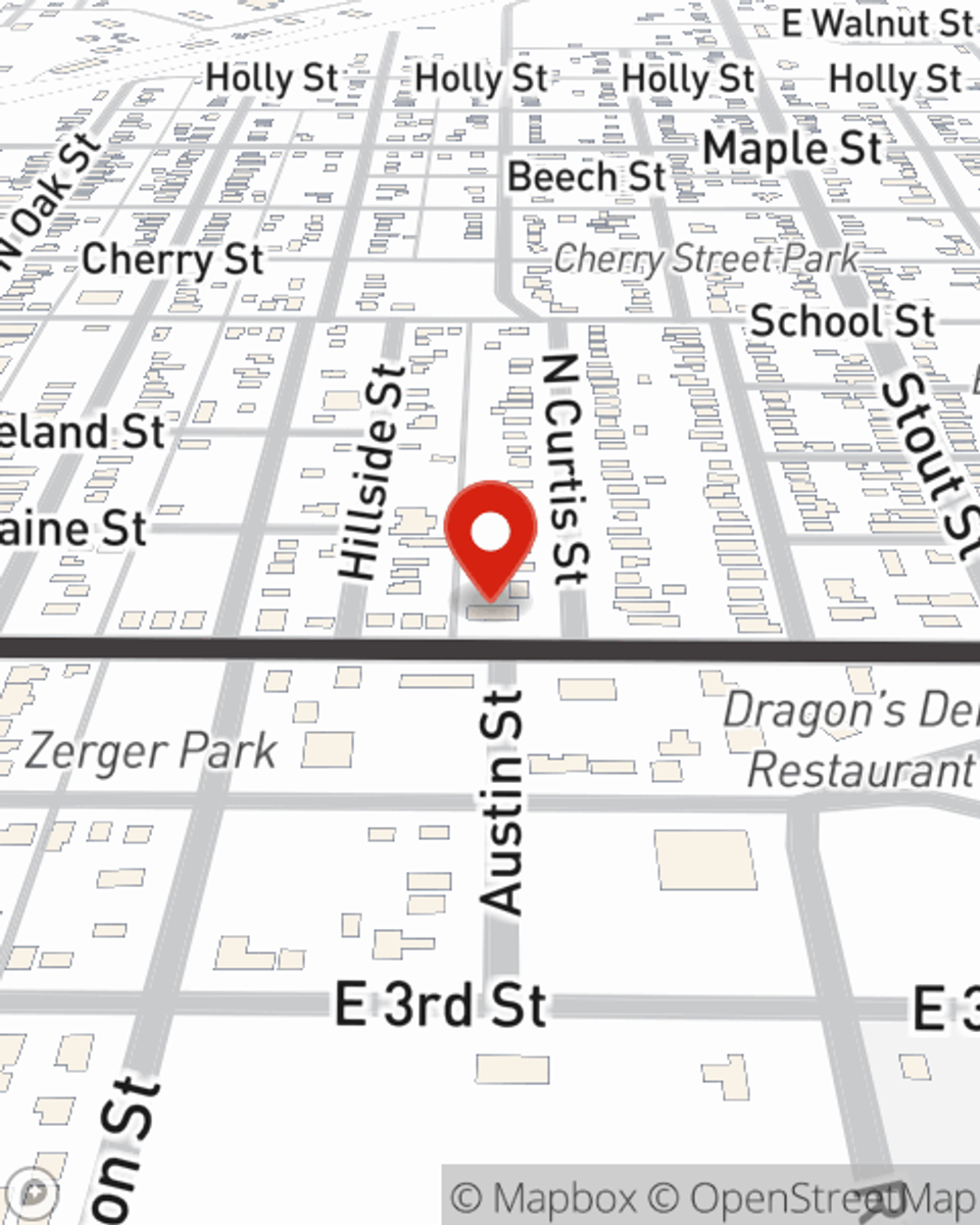

Homeowners Insurance in and around Pratt

Protect what's important from catastrophe.

Help cover your home

Would you like to create a personalized homeowners quote?

- Greensburg, KS

- Barber County

- Comanche County

- Kiowa County

- Edwards County

- Stafford County

- Kingman County

- Reno County

Welcome Home, With State Farm Insurance

Your home and property have monetary value. Your home is more than just a roof over your head. It’s all the memories you hold dear. Doing what you can to keep your home protected just makes sense! And one of the most reasonable things you can do is to get excellent homeowners insurance from State Farm.

Protect what's important from catastrophe.

Help cover your home

State Farm Can Cover Your Home, Too

For insurance that can help insure both your home and your possessions, State Farm has options. Agent Johnny Dykes's team is happy to help you develop a policy today!

Having great homeowners insurance can be invaluable to have for when the accidental happens. Reach out to agent Johnny Dykes's office today to get the home coverage you need.

Have More Questions About Homeowners Insurance?

Call Johnny at (620) 672-3485 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to select the right safe for you

How to select the right safe for you

Home safes are available in a variety of types and have ratings to indicate how secure they are. Read on to select the best type for your needs.

How to use public Wi-Fi safely

How to use public Wi-Fi safely

When using a public Wi-Fi access there can be risks involved. We’ve provided some steps to help protect your information.

Johnny Dykes

State Farm® Insurance AgentSimple Insights®

How to select the right safe for you

How to select the right safe for you

Home safes are available in a variety of types and have ratings to indicate how secure they are. Read on to select the best type for your needs.

How to use public Wi-Fi safely

How to use public Wi-Fi safely

When using a public Wi-Fi access there can be risks involved. We’ve provided some steps to help protect your information.